For a very long time, gold and silver have been regarded as the best methods of investing in precious metals and have been sought after. Precious metals investing still has a place in an intelligent investor’s portfolio today. But which precious metal is the best investment? And why are they erratic?

There are numerous ways of purchasing precious metals like gold, silver, and platinum, as well as numerous justifications for giving in to your need to go on a treasure hunt. To discover more about precious metals and how to invest in them if you’re just getting started, continue reading.

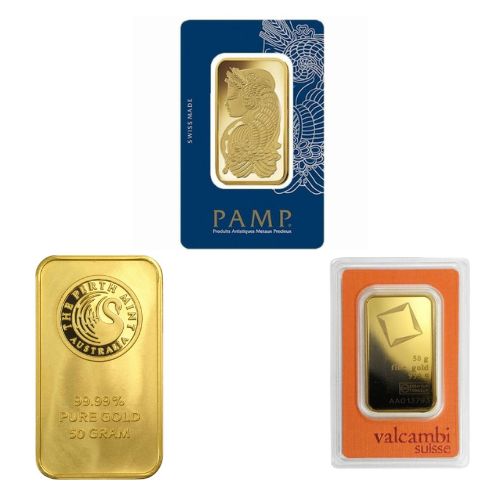

Before we dive into how to invest in precious metals let’s take a quick overview of the types of precious metals we can invest in. Below are some precious metals to consider for investment:

Gold

The most popular and sought-after method of investing in precious metals is gold. Its resilience (it doesn’t rust), capacity for shape, and capacity to conduct heat and electricity make it unique. Although it has minor industrial applications in electronics and dentistry, its primary usage is in manufacturing jewelry and as a medium of exchange. It has traditionally served as a valuable repository. As a result, investors look to buy gold as a hedge against rising inflation during periods of economic or political turmoil.

Many factors cause the increased desire to stockpile gold:

- Systemic financial worries: Gold has historically been sought after as a safe store of value when banks and money are thought to be unstable and political stability is in doubt.

- Inflation: People frequently resort to gold as a haven asset when actual rates of return in the equities, bond, or real estate markets are negative.

- Political unrest: It has always led to gold hoarding on the part of the populace. You can make a lifetime’s worth of savings portable and store them until you need to exchange them for food, shelter, or a safe journey to a less dangerous location.

Silver

The second most prevalent and sought-after method of investing in precious metals is silver. The electrical, electronic, and photographic industries employ this significant industrial metal. For instance, silver is a crucial component in solar panels due to its electrical characteristics. Jewelry, silverware, coins, and bars are all made of silver, which also serves as a store of value.

The price of silver tends to be more erratic than gold due to its dual use as an industrial metal and a store of value. Stock prices for silver can be significantly impacted by volatility. During significant industrial and investment demand, silver prices can occasionally outperform gold.

These fluctuations are always accompanied by new innovations, such as:

- The price of silver is more erratic than gold since it serves as both an industrial metal and a store of value.

- The volatility may have a significant effect on the pricing of silver stocks.

- When there is strong demand from investors and the industry, silver prices may occasionally outperform gold.

Platinum

Platinum is traded constantly on international commodities, just like gold and silver. Because it is significantly rarer than gold, it frequently commands a more fantastic price (per troy ounce) during regular times of market and political stability. Much less metal is dug up from the earth each year.

Like silver, the primary usage of platinum is industrial. It is crucial to the auto industry since it is used to create catalytic converters, which aid in lowering exhaust emission levels. Platinum is also used in the oil and refining industries, as well as in the computer business. Also used to make jewelry is platinum. Due to its scarcity, the metal has some investment potential, albeit not as much silver or gold.

Factors determining the price of platinum are:

- Platinum is also considered an industrial metal due to its tremendous demand from automotive catalysts, which are used to reduce the harmfulness of emissions. After this, jewelry accounts for most of the demand, followed by petroleum and chemical refining catalysts, and the computer industry uses up the rest.

- Due to the car industry’s considerable reliance on metal, auto sales and production figures play a significant role in setting platinum prices.

- South Africa and Russia are the only nations with a significant concentration of platinum mining. Due to this, there is a higher chance that cartel-like behavior will support or even artificially inflate platinum prices.

Palladium

Another metal with important industrial use is palladium. It is utilized in jewelry, dentistry, medical uses, industrial items, electronics, and groundwater treatment. Investors don’t place as much importance on palladium as other precious metals, even though it is precious and uncommon for those uses.

Feature of Palladium:

- Palladium is slightly rarer.

- Palladium is harder.

- Palladium is less costly due to lesser demand.

- Palladium is popular in industrial usage./

- Uses of palladium are in Bullion, Industries, and Jewelry.

What To Look For When Investing In Precious Metals?

Being an educated consumer is an inoculation against scams and bad investments. To sharpen your discernment, you must know what to look for when you set out to make your purchase.

Reputation

The first thing you need to look for when buying precious metals is a reputable dealer you can trust. Research the reputation of the company you’re looking to buy from. How long have they been in business? What do people say about them? Where are they located—can you visit them in person?

If other people can vouch for how knowledgeable the company is and how they were able to deliver a smooth buying experience, you can feel more at ease doing business with them. A gold trading business that is candid and informative will assuage your apprehension about hidden fees and unexpected charges.

Physical Presence

Find a vendor with an office presence. Take advantage of the opportunity for precious metals investments in person. Sitting face-to-face with your dealer, seeing the products, and asking all the questions you have in a real-life conversation will ensure the best buying experience for you. The legitimacy of a physical office transmutes the uncertainty of the internet.

Don’t Focus on the Wrong Things

Contrary to what some people believe, you don’t need to look for a company with a large selection.

A large selection sounds like a treat because you feel like the business went out of its way to provide you with various choices. The reality is more logistical than emotional.

In the gold trading business, 98% of buyers are interested in the same items. If a company has a large inventory, it will take them longer to move the items requested less frequently. This requires them to charge more across the board to make up for their dead inventory. Intentionally keeping an inventory of only the most popular items is a practical decision for a business. Most dealers will have variety in their inventory by buying coins or bullion from customers.

Keep It Simple

Investing in gold is something you want to have an ongoing business relationship with. A reliable dealer is an extension of the security you are afforded by protecting your wealth with physical assets. Bullion Trading LLC makes the purchasing process simple, exclusive, and discreet so you can continue to grow your portfolio and foster the kind of peace of mind that comes with financial security.

Pros And Cons Of Investing In Precious Metals

For investors, precious metals investments have a number of pros, such as:

- Protection from inflation Prices for precious metals typically increases at or above the inflation rate.

- Precious metals are tangible assets that are valuable for uses other than investing, such as jewelry or industrial applications.

- A somewhat liquid investment, it is: Precious metals, particularly investment goods, can be swiftly sold and converted into cash.

- Diversifies a portfolio by providing: Precious metals’ price changes can diverge from those of the stock and bond markets.

Some of the cons of precious metals are:

- There are expenses associated with storing and insuring real metals.

- The possibility of theft is also present.

- Furthermore, if you sell them for a profit, the IRS taxes them as collectibles.

- Direct investments in precious metals have the additional drawback of not producing income.

Is purchasing precious metals a good investment for you?

Because they have intrinsic worth, don’t involve any credit risk, and can’t be inflated, precious metals provide a particular form of inflationary protection. Thus, you are unable to print any more of them. Additionally, they provide real “upheaval insurance” against monetary, political, or military upheavals.

From the perspective of investment theory, precious metals also offer a low or negative correlation to other asset classes, such as equities and bonds. This implies that when you buy precious metals, even a tiny proportion will lower volatility and risk in a portfolio.

Also, read Best Gold Coins To Invest In 2022 & Why Investing in Physical Gold and Silver.

Conclusion for Precious Metals Investing

There are many benefits of investing in precious metals because they constitute a distinct asset class from stocks and bonds, which are only partially connected and present certain risks and possibilities. Because of this, they are especially well suited for use in a portfolio diversification approach. The ideal strategy will depend on your objectives among the several ways to invest in gold and silver.

We urge you to look through Bullion Trading LLC’s range of gold, silver, and platinum or palladium bullion once you’ve thought about how you’d like to start investing in precious metals. There are certain to be products in our huge product inventory that will attract people with different interests. The options are unlimited when it comes to constructing your precious metals portfolio, whether you want to begin with sovereign coins that have been gathered globally or something a little more exotic.